LAS VEGAS & RENO, Nev.--(BUSINESS WIRE)--Aug. 1, 2023-- Caesars Entertainment, Inc., (NASDAQ: CZR) (“Caesars,” “CZR,” “CEI” or “the Company”) today reported operating results for the second quarter ended June 30, 2023.

Second Quarter 2023 and Recent Highlights:

- GAAP net revenues of $2.9 billion versus $2.8 billion for the comparable prior-year period.

- GAAP net income of $920 million compared to net loss of $123 million for the comparable prior-year period, with the increase primarily driven by a release of $940 million of valuation allowance against deferred tax assets associated with our REIT leases.

- Same-store Adjusted EBITDA of $1.0 billion versus $978 million for the comparable prior-year period.

- Same-store Adjusted EBITDA, excluding our Caesars Digital segment, of $996 million versus $1.0 billion for the comparable prior-year period.

- Caesars Digital same-store Adjusted EBITDA of $11 million versus $(69) million for the comparable prior-year period.

Tom Reeg, Chief Executive Officer of Caesars Entertainment, Inc., commented, “The second quarter of 2023 reflected continued strength in our business. Demand remains strong in both Las Vegas and our regional markets. Caesars Digital posted its first quarter of positive adjusted EBITDA since our rebranding to Caesars Sportsbook in the third quarter of 2021. Our capital investments are generating stronger than expected returns based on recent new property openings.”

Second Quarter 2023 Financial Results Summary and Segment Information

After considering the effects of our completed divestitures, the following tables present adjustments to net revenues, net income (loss) and Adjusted EBITDA as reported, in order to reflect a same-store basis:

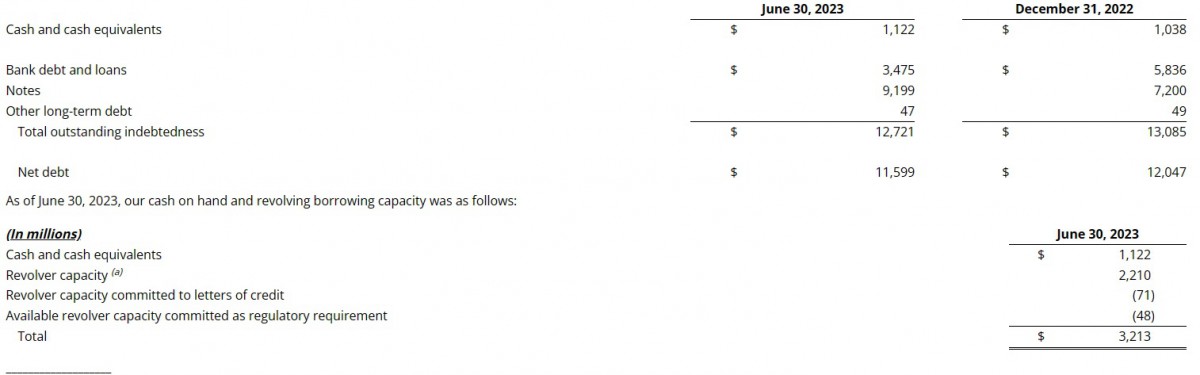

| (a) |

Revolver capacity includes |

“On

Reconciliation of GAAP Measures to Non-GAAP Measures

Adjusted EBITDA (described below), a non-GAAP financial measure, has been presented as a supplemental disclosure because it is a widely used measure of performance and basis for valuation of companies in our industry and we believe that this non-GAAP supplemental information will be helpful in understanding our ongoing operating results. Management has historically used Adjusted EBITDA when evaluating operating performance because we believe that the inclusion or exclusion of certain recurring and non-recurring items is necessary to provide a full understanding of our core operating results and as a means to evaluate period-to-period results. Adjusted EBITDA represents net income (loss) before interest income and interest expense, net of interest capitalized, (benefit) provision for income taxes, depreciation and amortization, (gain) loss on investments and marketable securities, stock-based compensation, impairment charges, equity in (income) loss of unconsolidated affiliates, (gain) loss on the sale or disposal of property and equipment, changes in the fair value of certain derivatives, and transaction costs associated with our acquisitions and divestitures such as (gain) loss on sale, sign-on and retention bonuses, severance expense, business integration and optimization costs, contract exit or termination costs, and certain litigation awards or regulatory settlements. Adjusted EBITDA also excludes the expense associated with certain of our leases as these transactions were accounted for as financing obligations and the associated expense is included in interest expense. Adjusted EBITDA is not a measure of performance or liquidity calculated in accordance with accounting principles generally accepted in

Conference Call Information

The Company will host a conference call to discuss its results on

Once registered, participants will receive an email with the dial-in number and unique PIN number to access the live event. The call will also be accessible on the Investor Relations section of Caesars Entertainment’s website at https://investor.caesars.com.

About

.gif)